- MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 HOW TO

- MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 UPDATE

- MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 FREE

‘How to Turn $100 into $1,000,000’ by James McKennaīest finance podcast for financial advice:īest finance blogs for personal finance tips:

‘The Richest Man in Babylon’ by George S. ’21st Century Wealth’ by Rachel Podnos O’Leary Here are some of our favorite resources you should look into:īest finance books to help you build wealth: With the myriad of financial books, blogs, and podcasts available online, it’s never been easier to educate yourself on financial topics. Read Financial Books and Blogs, Listen to Podcasts This budgeting worksheets help you identify your fixed and variable expenses so you have a better idea of where your money is going each month.

MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 HOW TO

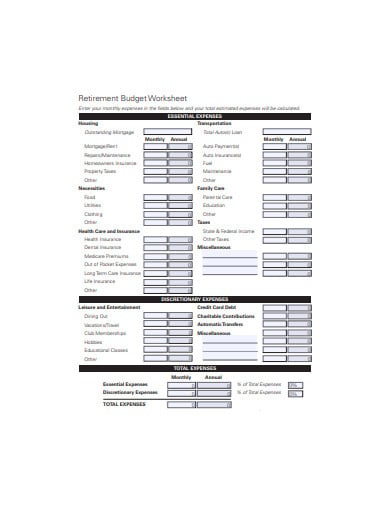

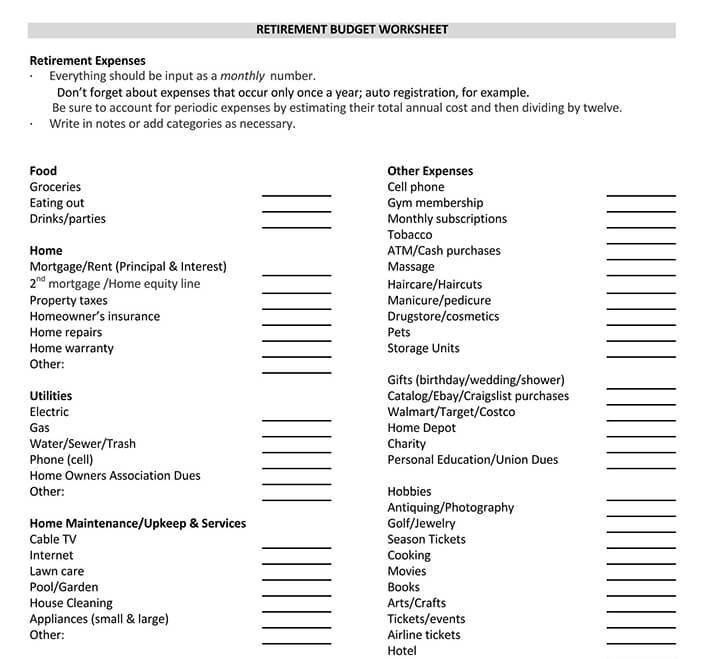

Another way to learn how to make a monthly budget that fits within your lifestyle is by using this budgeting worksheet to track your spending. The former suggests allocating 80% of your income to expenses and the remaining 20% to savings, while the latter recommends dividing your expenses into three categories: 50% for necessities, 30% for discretionary spending, and 20% for savings. If you’re not tech savvy and prefer not to use budgeting apps, you can still create budget by following budgeting methods like the 80/20 or 50/30/20 methods.

MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 UPDATE

These apps connect to your checking accounts and will automatically update every time you make a purchase.Ĭhoosing a budgeting method.

MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 FREE

Free budgeting apps like Mint and Honeydue are great tools to help you categorize and track your expenses. So, to become better at managing your money, you must have a budget. And even if you make $100,000 a month, you could still struggle to keep your finances afloat if your expenses are greater than your income. Without a budget, it’s easy to find yourself drowning in bills and expenses that you just can’t seem to keep up with. Here are some tips to help you get started. Plus, you’ll know how to recognize the signs of predatory lending and avoid falling for lenders who take advantage of borrowers who don’t fully understand their options.ĭon’t worry if you’re not where you want to be in terms of your knowledge on money - It’s never too late to improve your financial literacy. With financial literacy, you can better understand the terms and conditions of loans and credit cards and make informed decisions about borrowing money. While credit cards and loans might seem like easy solutions to our money problems, not knowing how to manage them wisely can often leave you struggling with payments for years. Take Our Poll: Are You Concerned About the Safety of Your Money in Your Bank Accounts? Avoid Debt Trapsĭebt traps are vicious cycles that can be challenging to pull yourself out of, especially if you lack financial literacy. By taking the time to educate yourself, you’ll be more in control of your money and better equipped to make financial decisions on your own. Without financial knowledge, it can be difficult to make the right investment decisions and confidently allocate your funds in a way that’ll yield positive returns in the future. adults correctly answered only 50% of the index questions, which cover a range of topics including debt, saving and investing. According to the 2022 TIAA Institute-GFLEC Personal Finance index, U.S. Others studies have also shown that most Americans lack financial literacy. Here are several reasons financial literacy is an important life skill you can’t ignore. Read: How To Build a Financial Plan From ZeroĬlearly, financial illiteracy is an issue that needs to be addressed throughout our society. Another way to put it - a lack of money knowledge can be costly. Only a quarter of those surveyed reported no financial damages.įind Out: 6 Types of Retirement Income That Aren’t Taxable Over 10% of respondents revealed that it has cost them more than $10,000 in the past year alone, and a staggering 62% of participants reported losses ranging from a cent to $10,000.

According to a recent GOBankingRates survey, most Americans believe their lack of financial knowledge has resulted in real monetary losses.

0 kommentar(er)

0 kommentar(er)